Award-winning PDF software

How to prepare Form Cms 1500 Claim

About Form Cms 1500 Claim

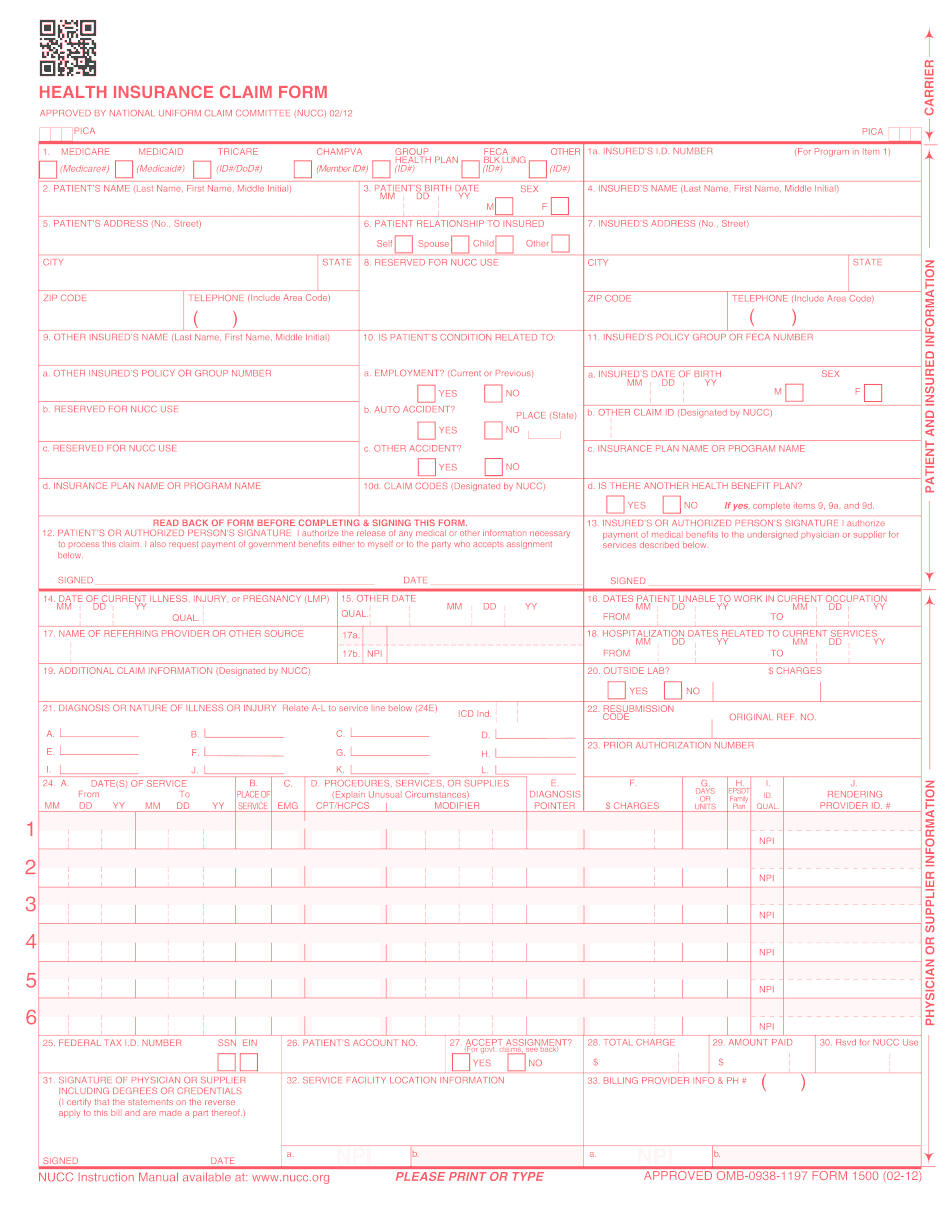

Form CMS 1500 Claim is a standard paper claim form used by healthcare providers to submit claims for reimbursement of healthcare services provided to patients, under the Medicare and Medicaid programs. The form is used to bill all third-party payers, such as private insurers and government health plans. The CMS 1500 form is required by healthcare providers, including physicians, hospitals, clinics, and other healthcare practitioners who want to bill for medical services provided to patients. This form is used to report necessary information, such as the patient's demographic information, diagnoses, procedures performed, and insurance information, to insurance carriers and third-party payers for reimbursement. The form ensures that healthcare providers are reimbursed accurately for their services and keeps a record of all billing data for future reference.

What Is CMS 1500?

The typical CMS 1500 Form or Health Insurance Claim is a papers used by a non-institutional provider or supplier to bill Medical carriers and medical devices in case a supplier qualifies for a waiver from your Administrative Simplification Compliance Act requirement for digital submission of claims. CMS 1500 Form may also be used for invoicing of Medicaid State Agencies.

For consistency with digital deals, the template aligns with the demands of the Accredited Standard Committee X12 (ASC X12) Health Care Claim: Professional (837P) Version 5010 Technical Reports Type 3 (TR3s).

The top half of 1500 Form is intended for your patient's info when the bottom half needs to be done by the physician.

- Provide patient's name, address and city ZIP code, and contact number.

- Mark suitable boxes.

- Include signature.

- The doctor has to place the date of sickness, injury and so on.

- Indicate the provider's name.

- Provide additional claim info.

- Identify the diagnosis.

- Enter federal ID number, patient's account number, and service facility location information.

- Specify the total charge in addition to sum paid.

- Put signature.

You are able to submit the form to your Medicare carrier, Durable Medical Equipment Medicare Administrative Contractor, or A/B MAC digitally by using a device with application that suits online submitting requirements established with the HIPAA claim and certain CMS requirements.

Contact your Medicaid State Agency for additional information.

Online systems help you to manage your doc administration and boost the productiveness of your respective workflow. Comply with the fast manual with the intention to accomplish Form CMS 1500 Claim, refrain from flaws and furnish it promptly:

How to finish a CMS 1500 form?

- Online with the form, simply click Start Now and pass to the editor.

- Utilize the tips to finish the relevant fields.

- Include your personal information and facts and facts and contact information.

- Make certain that you enter appropriate knowledge and volumes in perfect fields.

- Meticulously glance at the content material of your form in addition to grammar and spelling.

- Refer the help area for those who have any doubts or get in touch with our Support team.

- Set a digital signature on your own Form CMS 1500 Claim when using the guide of Sign Tool.

- After the blank is accomplished, hit Done.

- Deliver the ready document through e-mail or fax, print it or save in your account.

PDF file editor enables you to certainly make modifications inside your Form CMS 1500 Claim from any online-connected gadget, modify it in accordance with your preferences, sign it electronically and distribute in numerous means.

What people say about us

It's a great idea to submit forms on the web

Video instructions and help with filling out and completing Form Cms 1500 Claim